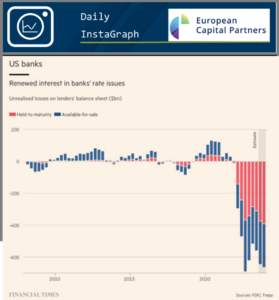

400 bn USD

Oct 10, 2023

US banks are currently sitting on more than 400 bn USD of unrealized losses in their bond portfolios. The amount of losses is at an all-time high and 10% higher than at the beginning of the year, just before the collapse of Silicon Valley Bank. We believe this duration mismatch between long term assets and the deposits is not a major problem, at least for the larger banks with little risk on a run on their deposits and a fire sale of their portfolios. The share prices of the US banks have remained weak and valuations look attractive to us. Time for a revisit the strongest ones.