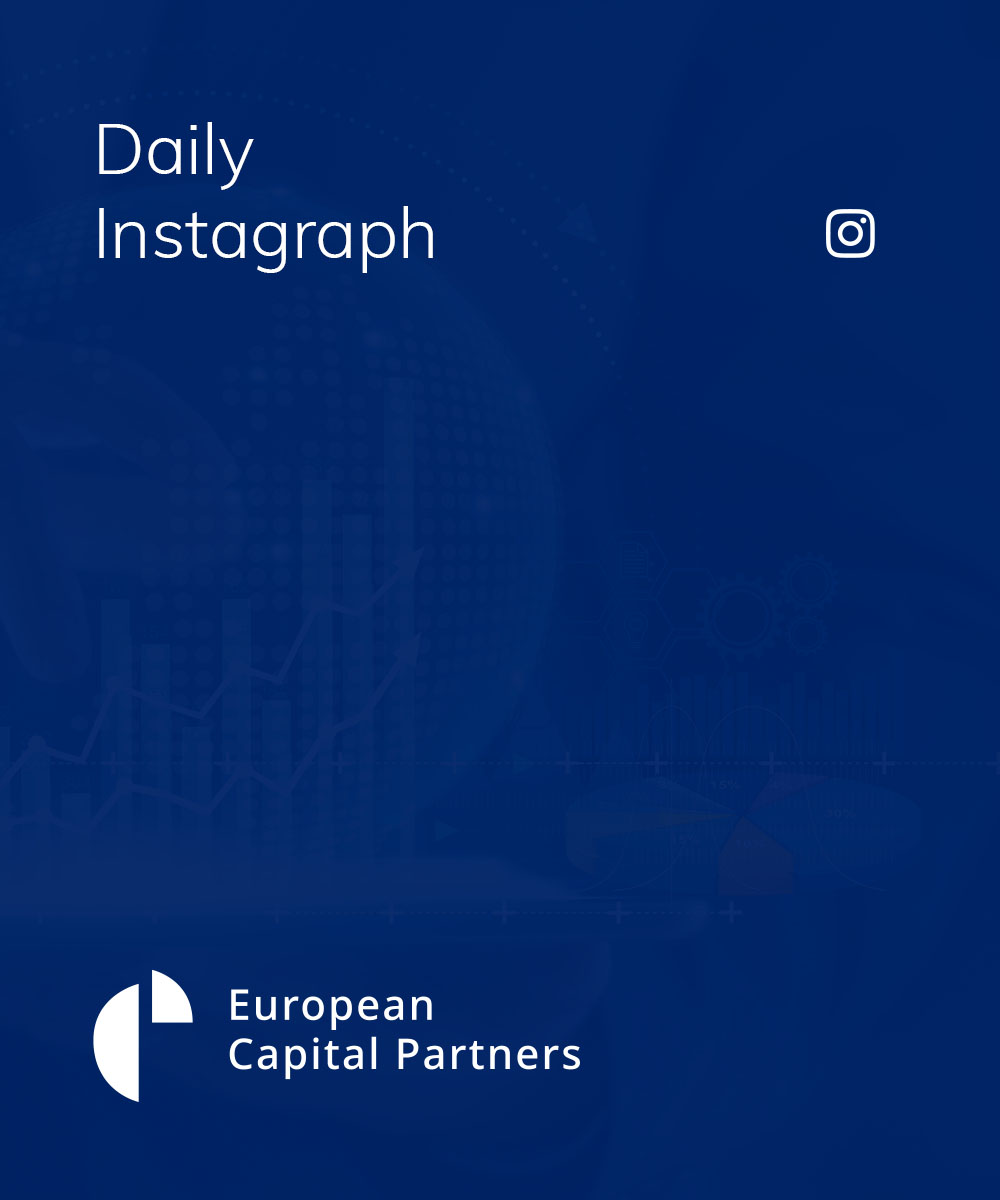

The end of free debt

Jan 11, 2023

The current global monetary tightening is expected to be the strongest since the early 1980s as measured by the G7 weighted policy rate (source: FT,Worldbank). The cost of credit has substantially increased, especially for the weaker borrowers. It has also resulted in the end of free money as zero or negative yielding debt has disappeared. At ECP, we see this as a ‘normalization’ of monetary conditions after years of extraordinary loose policies that is rapidly wiping out the excesses fuelled by cheap debt.