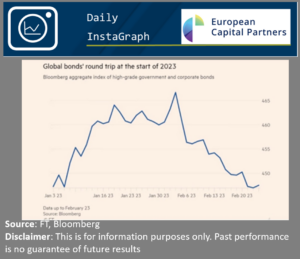

The silent rollercaster

Feb 27, 2023

Global high-grade government and corporate bonds had the best start ever in January with their index up 4%. Investors rushed back into bonds after a dreadful 2022 due to expectations that inflation was peaking and an end of central bank tightening was in sight. In February, bond markets worldwide gave back most of their gains of 2023 again as a whole series of stronger than expected macro and inflation data came in on both sides of the Atlantic. We continue to stress 2 of our core beliefs. First, we expect that inflation data will remain volatile in the short run as some parts ( think energy, shelter or the pandemic bottlenecks) will subside while other parts ( think food, labour market) may prove stickier. Secondly, the future central bank policies will remain data dependant but interest rates will continue to normalize and stay higher than what we have seen since the GFC. Our investment style remains particularly suited for such an environment.